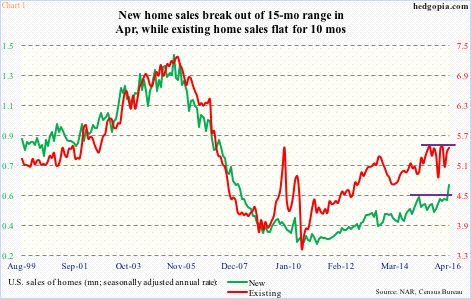

This week, May’s existing and new home sales data come out – on Wednesday and Thursday, respectively. In April, the former rose 1.7 percent month-over-month to a seasonally adjusted annual rate of 5.45 million units, and has essentially gone sideways since June last year. The latter jumped 16.6 percent to 619,000 units (SAAR) to break out of 15-month consolidation (Chart 1).

The median price in both categories remains elevated, with new homes selling for a record $321,100 in April and existing homes fetching $232,500, not that far away from a record $236,300 last June. This has the potential to crimp sales in the future.

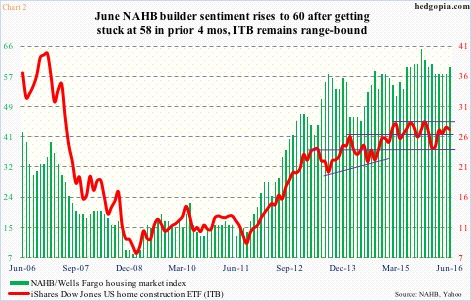

May’s housing starts were published last week, and came in at 1.16 million units (SAAR), down 0.3 percent m/m. Starts peaked last June at 1.21 million units, which were later matched in February this year. These were the strongest starts since 1.26 million units in October 2007. On a 12-month rolling average basis, starts were 1.156 million units in April, versus 1.15 million units in March. In other words, they are beginning to give out signs of sideways action.

This is reflected in builder sentiment, which stayed stuck at 58 for four months to May. June inched up to 60, but was still below 65 last October, which was a 10-year high. Chart 2 plots builder sentiment against ITB, the iShares US home construction ETF. The two track each other well.

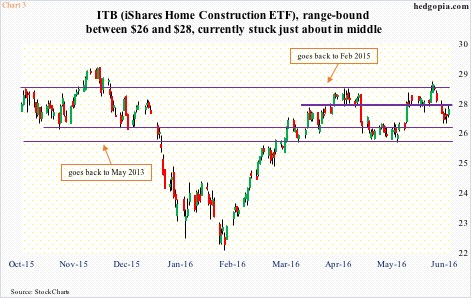

The ETF has been stuck between $26 and $28 for over a year now (Chart 3). Playing the ranges should continue to bear fruits until it breaks one way or the other.

Hypothetically on June 1st, it was shorted near the upper bound of the range, at $27.59. ITB even broke out briefly, before coming under renewed pressure, dropping to $26.69 last Tuesday. But by Friday, it had rallied back up to $27.26, also reclaiming the 50-day moving average. It is currently in the middle of the range, and could go either way near-term.

Weekly conditions remain overbought, so medium-term odds are probably skewed to the downside. Near-term, though, it is a toss-up. Worth covering – for now.

Thanks for reading!