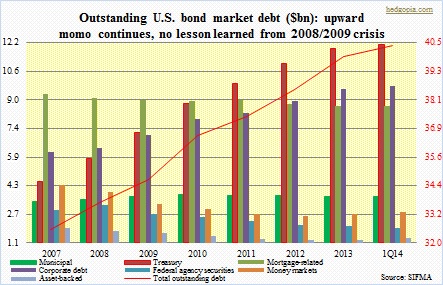

The title of the accompanying chart says it all. Despite all the talk behind the ongoing de-leveraging, facts point us to a different reality. Compared to 2007, the outstanding U.S. bond market debt is higher, not lower – $40.4tn in 1Q14, vs. $32.6tn back then. Selectively, yes, there has been progress. Of the seven different categories identified by SIFMA, three have experienced a decline – federal-agency securities, money markets, and asset-backed. But these are also small in size. The three large categories are treasury, mortgage-related, and corporate debt. Of these, ‘mortgage-related’ has gone down from $9.4tn to $8.7tn – understandable given the crisis in housing and the resultant refinancing/foreclosure, etc. – even as treasury debt surged from $4.5tn to $12.1tn and corporate debt from $6.1tn to $9.8tn.

The title of the accompanying chart says it all. Despite all the talk behind the ongoing de-leveraging, facts point us to a different reality. Compared to 2007, the outstanding U.S. bond market debt is higher, not lower – $40.4tn in 1Q14, vs. $32.6tn back then. Selectively, yes, there has been progress. Of the seven different categories identified by SIFMA, three have experienced a decline – federal-agency securities, money markets, and asset-backed. But these are also small in size. The three large categories are treasury, mortgage-related, and corporate debt. Of these, ‘mortgage-related’ has gone down from $9.4tn to $8.7tn – understandable given the crisis in housing and the resultant refinancing/foreclosure, etc. – even as treasury debt surged from $4.5tn to $12.1tn and corporate debt from $6.1tn to $9.8tn.

To this blogger, what really stands out is the rise in corporate debt. This runs in contrast with all the talk behind how healthy corporate balance sheet is. To be fair, corporations undoubtedly have a healthier cash cushion. Cash flow has been healthy. In 1Q14, for instance, corporate net cash flow with IVA (SAAR) was $2.1tn, down from 3Q13’s $2.3tn but still very healthy. Corporations have benefited from the refi boom, among others. But all along, the liabilities side bulked up as well. SIFMA data also shows that U.S. corporations last year issued $1tn in investment-grade and $336bn in high-yield bonds, up from $664bn and $43bn, respectively, in 2008. The irony is that not all of it has gone into productive uses such as capital spending. Rather a majority has found its way into dividend payments and stock buybacks. The latter in particular has taken place as stocks persistently record new highs. On average, each buyback is taking place at a higher price than the one before that. In an environment in which sales growth is anemic, buybacks help the bottom line – kind of a smoke-and-mirror show. All hunky-dory now, but will have implications for corporate profits in the out years.