Here is a brief review of period-over-period change in short interest in the December 16-30 period in the Nasdaq and NYSE Group as well as nine S&P 500 sectors.

There has been widespread decline in short interest.

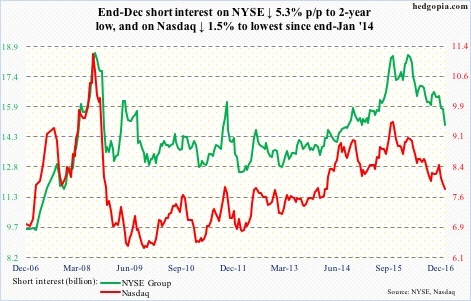

Nasdaq – short interest ↓ 1.5% p/p; Nasdaq composite ↓ 1.4%

The composite was down during the reporting period, but scored a new intra-day high of 5512.37 on December 27 (surpassed later by a fresh high of 5564.25 this Tuesday).

Shorts decided to cash in. Short interest has now dropped 7.2 percent in the past month and a half, and is at the lowest since the end of January 2014.

NYSE Group – short interest ↓ 5.3% p/p; NYSE composite ↓ 0.7%

The daily chart shows the index had a massive reversal on December 27 – surged five percent intra-day only to close up 0.16 percent. Not sure what to make of this, but if we forget this outlier, there was not a whole lot of change in the December 16-30 period.

Resistance at 11250 remains, and a convincing breakout probably ends up squeezing the shorts, who are acting like they expect one. Short interest dropped 5.3 percent during the period, and is at a two-year low.

…

Of the nine S&P 500 sectors below, short interest fell p/p in all except XLI. During the period, all nine sectors were above their 50-day moving average.

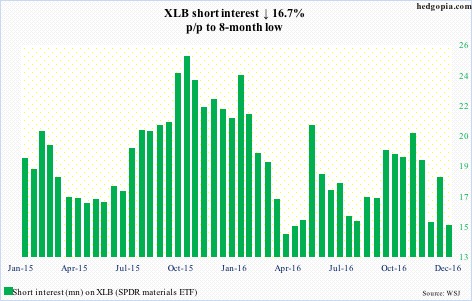

XLB (SPDR materials ETF) – short interest ↓ 16.7% p/p, ETF ↓ 1.7%

Support at $50 goes back to February 2015, which was defended on December 30. From bulls’ perspective, that is the good thing. At the same time, they are probably not so excited about the monthly gravestone doji in December.

Regardless, shorts decided to cut back to an eight-month low.

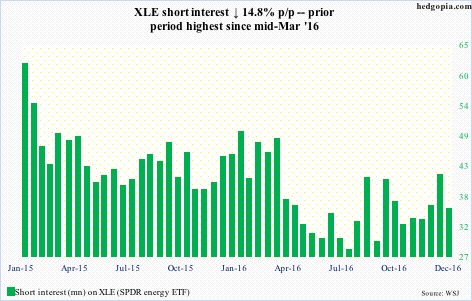

XLE (SPDR energy ETF) – short interest ↓ 14.8% p/p, ETF ↓ 0.9%

In the prior period (December 1-15), XLE broke out of an ascending channel from April last year. Shorts, apparently not convinced this was a genuine breakout, added. They were onto something. XLE has been under pressure since the December 12th intra-day high of $78.04. December also produced a monthly long-legged doji.

Shorts did not stay put, though. They cut back.

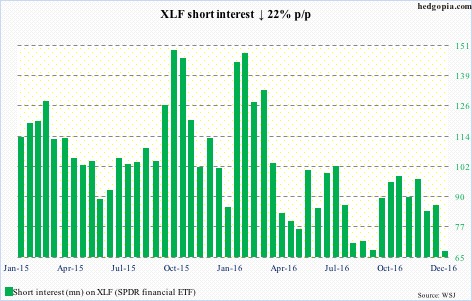

XLF (SPDR financial ETF) – short interest ↓ 22% p/p, ETF ↓ 1.3%

After rallying 19 percent post-election, XLF went on a sideways journey beginning December 8. This pretty much continued during the December 16-30 period.

Bears need to break $23.20 to get any traction. During the period, shorts covered big time – as if they expect a breakout in XLF.

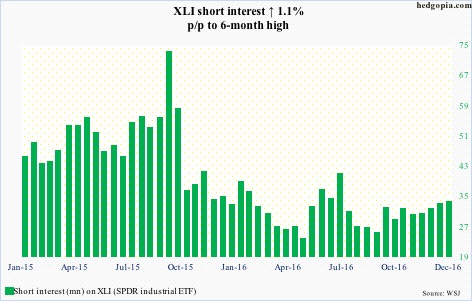

XLI (SPDR industrial ETF) – short interest ↑ 1.1% p/p, ETF ↓ 0.8%

November’s large hollow candle, in which XLI jumped 9.1 percent, has been followed by a gravestone doji in December. Through December 30, the ETF had been sideways for nearly a month. This was preceded by a huge post-Trump rally. Shorts nonetheless are taking it easy – unwilling to get too aggressive.

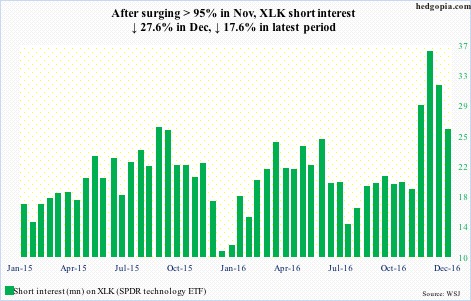

XLK (SPDR technology ETF) – short interest ↓ 17.6% p/p, ETF ↓ 1.2%

On December 27, XLK rallied to a new all-time high of $49.40 (now surpassed by a fresh intra-day high of $49.63 this Wednesday), but only to come under pressure in the final three sessions of 2016.

That said, support at $48, which XLK had just broken out of, was defended on December 30. Shorts covered big.

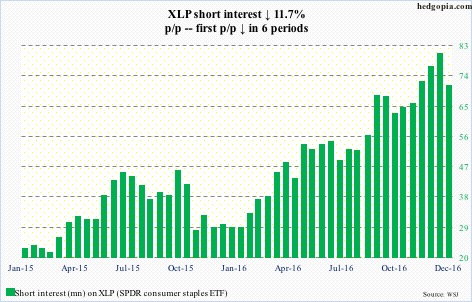

XLP (SPDR consumer staples ETF) – short interest ↓ 11.7% p/p, ETF ↓ 0.01%

On December 15, XLP found support at its 50-day moving average. The subsequent rally was resisted just under the 200-day in the December 16-30 period.

Shorts have accumulated sizable short interest, even though they cut back some.

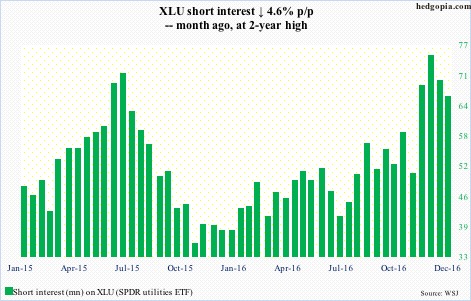

XLU (SPDR utilities ETF) – short interest ↓ 4.6% p/p, ETF ↑ 1.5 %

On the last day of the prior reporting period (December 1-15), the 50-day moving average was defended. After rallying in the initial sessions of the December 16-30 period, XLU pretty much went sideways around the 200-day ($48.46). This resistance also goes back to March last year.

For the most part, shorts are staying put.

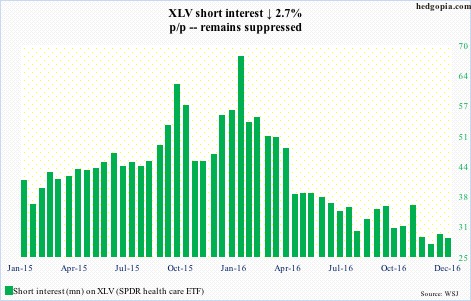

XLV (SPDR healthcare ETF) – short interest ↓ 2.7% p/p, ETF ↓ 0.8%

In August this year, XLV came within pennies of the July 2015 all-time high. This unsuccessful test led to a sharp drop into a November bottom. Since then, it has been making higher lows. Bulls also defended the 50-day moving average – now turning up. The 200-day moving average lies above.

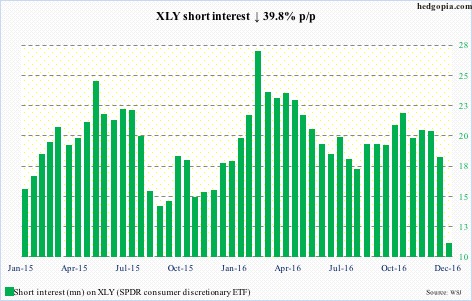

XLY (SPDR consumer discretionary ETF) – short interest ↓ 39.8% p/p, ETF ↓ 2%

XLY rallied to a new all-time high of $84.19 on December 13, and that high was not challenged during the December 16-30 period. Four-month support at $81-plus was defended, though; this support at the time also approximated the lower Bollinger band.

During the reporting period, although short interest was reduced by two-fifths, the ETF still went down. Shorts nonetheless are behaving like they expect a breakout.

Thanks for reading!