A crucial test probably lies ahead for the S&P 500 large cap index (Chart 1).

The index, trapped in a sideways pattern since essentially February last year, broke out nearly a month ago – potentially a huge development, with the usual if’s and but’s.

Large-caps’ breakout has not been able to pull along the likes of transports and small-caps. Both are yet to score new highs. Volume has been anemic – no sign of institutional footprint. We will find out if institutions instead have been waiting to jump the ship after retail jumps on the breakout bandwagon.

There are some signs the breakout has indeed excited the average retail investor.

The S&P 500 broke out on July 11th. In the week ended July 13th, $8.3 billion moved into SPY, the SPDR S&P 500 ETF; in the week before that, $4.6 billion came in (courtesy of ETF.com). This was followed by outflows of $1.1 billion in the week ended July 20th and inflows of $2.1 billion last week (July 27th).

As well, in the week ended July 13th, U.S.-based equity funds attracted $7.8 billion (courtesy of Lipper). These were the first inflows in 11 weeks.

The question is, will institutions take advantage of this and bail out or stay put? From the February 11th intra-day low of 1810.10 through Monday’s all-time high 2178.29, the S&P 500 rallied 20-plus percent, so it is tempting to lock in profit or at least prune positions. That may in part depend on what happens during breakout retest.

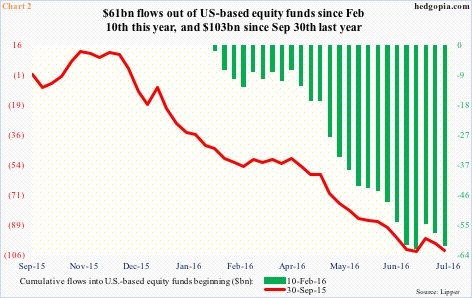

One major problem with the rally that began six months ago is that in a larger scheme of things it has not succeeded in stopping fund withdrawals. Since the week ended February 10th this year (the S&P 500 bottomed a day later), $61 billion has left U.S.-based equity funds. Go back a little further, to the week ended September 30th last year (the S&P 500 bottomed a day earlier), these funds have lost $103 billion (Chart 2).

Kudos to the bulls for not letting these massive outflows disrupt their conviction/thesis.

The S&P 500 has broken out to a new high, pushing the index into deep overbought territory, even monthly. A little fatigue can always set in. Last week produced a ‘hanging man’ candle – potentially a bearish formation, although it needs confirmation. A lot is riding on the remaining two sessions. So far in the week, the S&P 500 (2163.79) is down 0.45 percent.

Hence the significance of imminent breakout retest. A failure at this juncture can begin a process of unwinding extended conditions – on several fronts. Besides overbought technicals, sentiment is elevated.

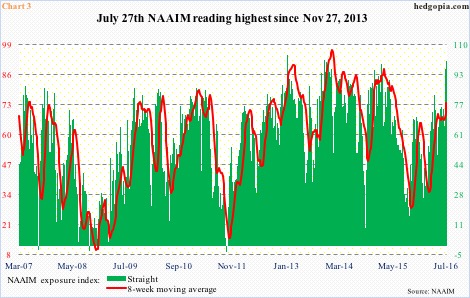

Investors Intelligence bulls’ count has remained above 50 percent for four weeks now. The National Association of Active Investment Managers exposure index represents members’ average exposure to US equity markets. These are people who manage real money. As of last Wednesday, the index stood at 101.02 – the highest since the week ended November 27, 2013 (Chart 3). In essence, they are all in.

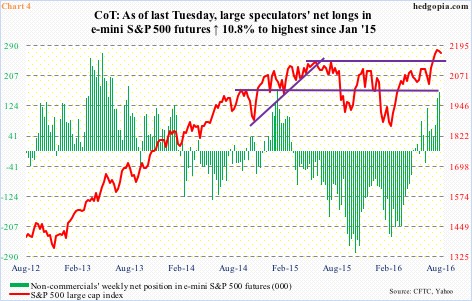

Or non-commercials’ net longs in e-mini S&P 500 futures, for that matter. In the week ended February 9th (this year), they were net short 234,321 contracts. As stocks bottomed and began to rally, these traders began to cover. These net shorts ended up being a major rally tailwind. Now they are net long – 162,082 contracts as of last Tuesday. From one extreme to the other. It does not take too long for them to turn tail, the same way they began to exit their net short positions as soon as markets turned in February.

Hence, once again, the significance of breakout retest. A failure thereof raises possibility of a failed breakout.

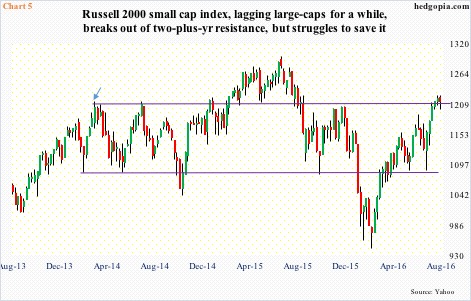

For a little reference, the Russell 2000 small cap index has been sideways since March 2014 (arrow in Chart 5). It then broke out in February last year, only to peak four months later; by August, it was back below the March 2104 high. Except for that failed breakout in June last year, the Russell 2000 has not been able to break out of its range, including one last week.

Failed breakouts are not uncommon. The only question is if a similar fate awaits the S&P 500, and how the bulls handle it.

Thanks for reading!