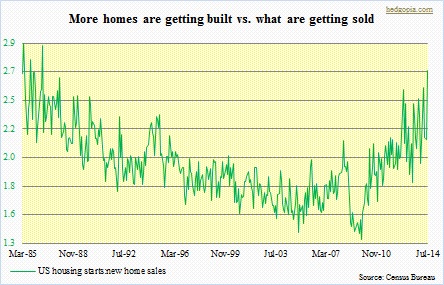

US housing starts were a real downer in August, down 14 percent month-over-month, to 956k. Multi-family really took it on the chin, down 32 percent (304k), even as single-family relatively fared better, down two percent (643k). Monthly data tend to be highly volatile, hence it is meaningless to be paying too much attention. July data was euphoric. August is in the dumps. Nevertheless, the overall trend does have an upward bias, though only slightly. For over three years now, the 12-month rolling total (at a seasonally adjusted annual rate) has been on an uptrend, to 979k in August. While this all seems fine and dandy, a couple of things probably needs to be emphasized. First is the adjacent chart. It is a simple ratio of housing starts to sales of new homes. As can be seen, the metric bottomed late 2009 and has been on an uptrend since. Needless to say, sales are falling way short of starts. The 12-month running total of new home sales (SAAR) peaked in January this year at 431k units (not shown here) and has been gradually weakening since. Sales have simply not lived up to expectations. Hence the rise in that ratio.

US housing starts were a real downer in August, down 14 percent month-over-month, to 956k. Multi-family really took it on the chin, down 32 percent (304k), even as single-family relatively fared better, down two percent (643k). Monthly data tend to be highly volatile, hence it is meaningless to be paying too much attention. July data was euphoric. August is in the dumps. Nevertheless, the overall trend does have an upward bias, though only slightly. For over three years now, the 12-month rolling total (at a seasonally adjusted annual rate) has been on an uptrend, to 979k in August. While this all seems fine and dandy, a couple of things probably needs to be emphasized. First is the adjacent chart. It is a simple ratio of housing starts to sales of new homes. As can be seen, the metric bottomed late 2009 and has been on an uptrend since. Needless to say, sales are falling way short of starts. The 12-month running total of new home sales (SAAR) peaked in January this year at 431k units (not shown here) and has been gradually weakening since. Sales have simply not lived up to expectations. Hence the rise in that ratio.

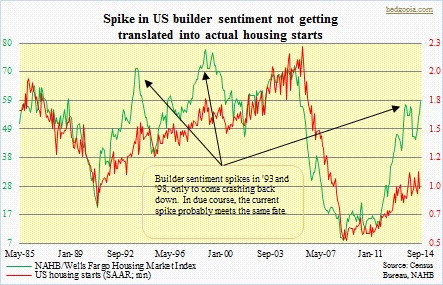

Now, here is the thing. Take a look at the accompanying chart. In it, housing starts have been plotted against builder sentiment. The September reading for the NAHB/Wells Fargo Housing Market Index the other day came in at 59 – which is the highest since November 2005. That says something. There is a lot of optimism among home builders, but they are not putting their money where their mouth is. In the chart, the gap between the two lines has continued to widen for over two years now. From the inventory perspective, it is a good thing that the red line has not followed the green line higher. In other words, if builders were both optimistic and also opening up their wallets, then we would be looking at much higher inventory, as sales have disappointed. Going back 30 years, this is the third time builder sentiment has had such a sharp spike. Previously, we saw the phenomenon in 1993 and 1998. On both occasions, starts do not follow the sentiment higher. Rather, in due course builders get a healthy dose of reality. Sentiment peaks, and the journey down is as steep, dragging starts along.

Now, here is the thing. Take a look at the accompanying chart. In it, housing starts have been plotted against builder sentiment. The September reading for the NAHB/Wells Fargo Housing Market Index the other day came in at 59 – which is the highest since November 2005. That says something. There is a lot of optimism among home builders, but they are not putting their money where their mouth is. In the chart, the gap between the two lines has continued to widen for over two years now. From the inventory perspective, it is a good thing that the red line has not followed the green line higher. In other words, if builders were both optimistic and also opening up their wallets, then we would be looking at much higher inventory, as sales have disappointed. Going back 30 years, this is the third time builder sentiment has had such a sharp spike. Previously, we saw the phenomenon in 1993 and 1998. On both occasions, starts do not follow the sentiment higher. Rather, in due course builders get a healthy dose of reality. Sentiment peaks, and the journey down is as steep, dragging starts along.