U.S. financials continue to send conflicting signals.

As important a sector as this one is, what happens next probably will hold clues to a whole host of things, ranging from what lies ahead for the U.S. economy to where interest rates might be headed.

In this regard, XLF, the Financial Sector SPDR ETF (24.85), sits at a critical juncture.

First of all, it has lagged the S&P 500 large cap index since the middle of 2013 – not by much, nonetheless the trend has been to the downside.

The ETF peaked late last year and is revisiting that level. On both Tuesday and Wednesday, it pounded on those highs. Without much success. So far, it has been denied of a new high. To put this in perspective, the S&P 500 notched new all-time highs this week.

The good thing, as far as XLF is concerned, is that buyers have consistently showed up at the October 2014 trendline (Chart 1). The latest rally began two weeks ago. During this time, several major financial stocks – JPM, WFC, MA and V – have broken out to new highs. As well, GS is trading at its highest level since late 2007. BRK.B is not that far away from December 2014 highs.

But this has not been enough to push the ETF past resistance.

JPM, V and BAC have each rallied five percent this month, GS four percent, BRK.B, C and MA three percent each, and WFC two percent. In so doing, they have used up a lot of energy.

In the ETF, the top three weights are given to BRK.B (8.7 percent), WFC (8.6 percent), JPM (and 8.1 percent). They have all rallied nicely this month.

Hence the risk that XLF will have a hard time breaking out before it takes a breather. Daily technicals are way overbought.

A failure here could mean a drop to 24.50. Right underneath lies the October 2014 trendline, which is a must-hold.

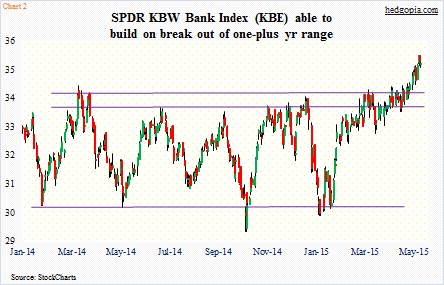

In all probability, KBE, the SPDR S&P Bank ETF (35.13), cannot remain immune from imminent weakness on the other. Yes, the makeup between the two ETFs is different. Yes, one (XLF) is dominated by large-caps, even as the other (KBE) is 78 percent exposed to U.S. regional banks (that is why it acts similar to KRE, its regional bank-focused cousin). Yes, XLF is trying to break out, while KBE already achieved that feat (Chart 2).

But at the end of the day, these are both financial ETFs, although KBE is predominantly exposed to the domestic economy. As a matter of fact, the fact that KBE has already broken out could bode well not only for the ETF itself but also for XLF down the line.

Here is the thing. Last Friday, KBE came pretty close to testing the broken resistance, at 34 (give and take). This week, the ETF has further pulled away from that resistance. A retest is probably around the corner. In an ideal world, the test is successful, and in due course XLF hammers out its own breakout. This is the optimistic scenario.

Here is what we do not want to see. KBE fails in its retest (a failed breakout), which in essence will be confirming XLF’s inability to break out.

Thanks for reading!