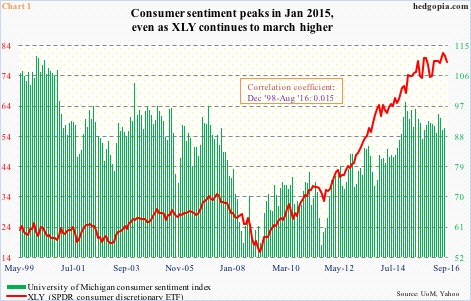

There is not much correlation between the University of Michigan’s consumer sentiment index and year-over-year change in personal consumption expenditures – mere 0.12 going back to January 1978 (chart here). Nor is there any between consumer sentiment and XLY, the SPDR consumer discretionary ETF.

Consumer sentiment reached a cycle high of 98.1 in January 2015. This was an 11-year high. Since January last year through last month’s all-time high, XLY rallied 20 percent. Correlation between the two is non-existent (Chart 1).

The ETF marches to the beat of its own drum, driven more by technicals than fundamentals … at least, it has been that way for a while.

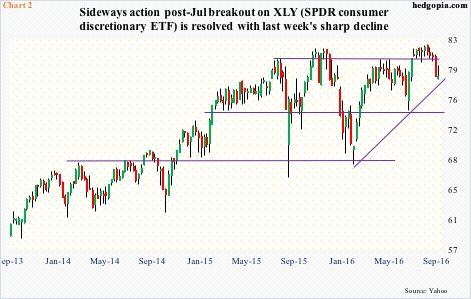

In July, XLY broke out of sideways action going back to November last year. It then went sideways for eight long weeks (Chart 2). This could potentially be a continuation pattern, which would suggest the prior trend – in this case, up – was likely to continue. But in the end the consolidation got resolved with a breakdown.

Weekly indicators are in the process of unwinding overbought conditions. Daily conditions are now oversold. The low this Monday was a hair’s breadth away from testing the 200-day moving average. The ETF also sits on a rising trend line drawn from the February 2016 low (Chart 2). If it stabilizes here, odds of XLY rallying to test the broken resistance have grown. The 50-day moving average, which is no longer rising but flat, approximates that resistance.

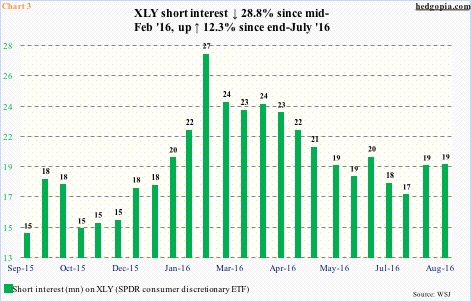

In this scenario, a little help can come from short interest.

The rally that began in early February this year owes a lot to XLY’s short interest, which declined from an elevated 27.3 million mid-February to 17.3 million by the end of July; in the following month, it rose to 19.4 million (Chart 3). This is not much, but can help the ETF rally should XLY bulls manage to defend the 200-DMA/trend line support.

XLY ($78.41) was shorted on August 18 at $81.50. Shorts can either (1) cover outright, (2) stay short, or (3) stay short but deploy options.

In a scenario in which the 200-DMA ($77.74) is defended near term, a short put can help earn some premium.

Hypothetically, September 23rd XLY 78 puts fetch $0.93. If assigned, it helps raise the price the underlying was shorted at to $82.43 for a profit of $4.43. Unassigned, the position stays short, only at a higher price.

That said, next week is FOMC meeting. Depending on what comes out of it and what hints they drop for the December meeting, stocks can rally – either post-meeting or even leading up to it.

Medium-term, it is worthwhile to stay short XLY. But for now, it is probably safe to cover, and wait for another opportunity.

Thanks for reading!