AAPL as a stock is back in the game. From its $677 mid-September 2012 all-time high to the mid-April 2013 low of $374 to last week’s high of $644, it has nearly done a round trip.

AAPL as a stock is back in the game. From its $677 mid-September 2012 all-time high to the mid-April 2013 low of $374 to last week’s high of $644, it has nearly done a round trip.

Recent sell-side commentary has been good. Price targets are getting raised. Numbers are getting raised. FY14 EPS estimates currently are $44.11, vs. $42.77 three months ago, while FY15 is pegged at $47.91, vs. $46.27 back then. The 8.6-percent FY15 bottom-line growth forecast is much better than the expected top-line growth of 6.3 percent. Better margins have been modeled in.

Accordingly, December-quarter iPhone estimates are going up. There is great optimism around the upcoming iPhone 6. Expectations are for a very strong iPhone 6 upgrade cycle. As well, sell-side commentary around AAPL’s recent purchase of Beats Music (music) and Beats Electronics (headphone maker) is rosy; the hope is that these purchases should enable AAPL to stem the decline in iTunes music download sales. In short, the overall mood is ebullient, though probably not as giddy as back when the stock peaked in September 2012.

What exactly has changed?

Fundamentally, not a whole lot. Its two main products – iPhones and iPads – are still the driving force, representing nearly 75 percent of the company’s FY13 revenues. Markets for both smartphones and tablets are growing nicely, but this is also attracting new entrants. The traction Xiaomi has had in China is just one example. And because AAPL started with a disproportionately high share of the tablet market, it is its to lose, as others are muscling in. Customers are owning tablets for much longer than in earlier years.

In terms of new products, we have not heard much. Its iTunes Radio, its attempt at a Pandora-line service, has failed to get off to a good start – probably the reason why Beats Music was snapped up.

For several years now, we have been hearing about the company coming out with a full-fledged TV set, not just an upgrade over its existing Apple TV. First of all, it is debatable if that would be a smart business decision. Plain-old TV business merely guarantees AAPL enters a low-margin business. Regardless it brings out a new TV set or updates its existing Apple TV, the only value-add AAPL can bring is by negotiating with cable partners for video content. Companies that own the content are less likely to get too excited by this idea anyway. A la carte, for instance, would be great for consumers, but not for cable operators. The sell-side also expects at least one wearable device this year; an iWatch is expected to be launched later this year.

The rumor mill constantly churns out hope/belief that Tim Cook and team would come up with something. Anything, but something. Nevertheless, success behind products such as the iPod, iPhone and iPad is not easy to be emulated. Steve Jobs was a genius, and he is no more. One of the many things lost with Jobs’ passing was his negotiating skills.

At the WWDC conference, the company did not update on Apple TV, payment platform (nearly 800mn credit cards through iTunes), CarPlay, and there was no new hardware.

Having said that, after all it is AAPL, with a cult-like following. It has got one hell of an ecosystem. The integration between iOS and OSX has gotten tighter. Both iTunes and App Store (1.2mn apps) have helped the company maintain loyalty toward its hardware business. New initiatives include HealthKit, which is designed to form a central repository for an individual’s health history and information, and HomeKit, which helps automate the household. But the latter two in particular will take time to get traction, if at all. For now, they will drain cash flow, not contribute. The bread and butter at the moment is the iPhone and iPad.

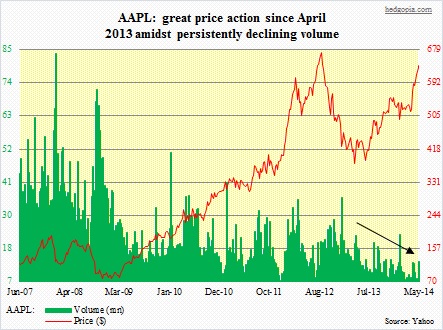

On the technical front, though, a lot has changed. Peak to trough, the stock dropped 45 percent in seven months, rendering it into grossly oversold conditions by the time it troughed in April of 2013. But prior to that peak the stock had also appreciated nearly 800 percent in about four years. The rally since April last year has not only taken care of the oversold conditions but has now pushed indicators into overbought territory – on near-, mid- and long-term. Back when it peaked in 2012, September had flashed a major distribution signal. There has not been any such signal so far.

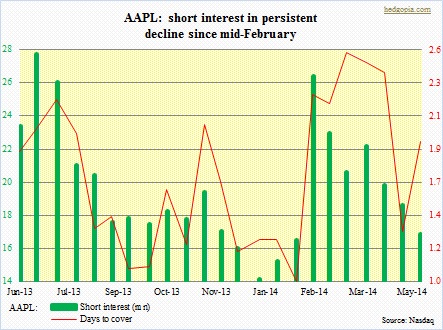

It has got a pristine balance sheet – net cash of $134bn as of CY1Q14. Annual cash flow is in the $48-$50bn range. On valuation, too, it does not look terribly expensive – 14.5x FY14 estimates and 13.3x FY15’s. Nevertheless, estimates are exactly that – estimates. Prior to the September 2012 peak (in the stock), sell-side analysts were constantly raising numbers, only to substantially lower them in the following months/quarters. Also, for a mega-market-cap stock like AAPL, there are other factors in play. In the end, there is only so much money to go around. Back in 2012, there probably was not a single growth fund that was not in AAPL knee-deep already. Who was left to buy? Ultimately, greater fool theory ends up governing the price. Once the music stops, there are not enough chairs left. And, last but not the least, short interest has been in decline since mid-February. Shorts have gotten squeezed out of this thing the past three months, and that fuel is not as potent.

It has got a pristine balance sheet – net cash of $134bn as of CY1Q14. Annual cash flow is in the $48-$50bn range. On valuation, too, it does not look terribly expensive – 14.5x FY14 estimates and 13.3x FY15’s. Nevertheless, estimates are exactly that – estimates. Prior to the September 2012 peak (in the stock), sell-side analysts were constantly raising numbers, only to substantially lower them in the following months/quarters. Also, for a mega-market-cap stock like AAPL, there are other factors in play. In the end, there is only so much money to go around. Back in 2012, there probably was not a single growth fund that was not in AAPL knee-deep already. Who was left to buy? Ultimately, greater fool theory ends up governing the price. Once the music stops, there are not enough chairs left. And, last but not the least, short interest has been in decline since mid-February. Shorts have gotten squeezed out of this thing the past three months, and that fuel is not as potent.

The stock has run up 20 percent the last three months alone. A lot has already been priced in.

So here is a possible scenario. The stock takes a breather from here. June-quarter numbers for the iPhone in particular will be weak in anticipation of the fall hardware refresh. Post-WWDC, the company probably does not have much to talk about in the near-term. Buyers may show up later, for the fall launch of the iPhone. Technically, next decent support lies at $550. I have been thinking about playing this scenario through August 2014 options – just to earn some premium by selling 660 calls for $16 and selling 550 put for $3, but have not initiated position yet.