The expected decline in the euro never came. Back on August 11, it looked like the currency was ready for a bounce. Just a bounce, as long-term technicals were only midway through unwinding overbought conditions hence did not call for a sustained rally. Bears simply looked too smug for their own good. Fast forward a couple of weeks, and they have once again been proven right. The FXE fell nearly two percent in August. Bears’ conviction is reflected in Russell 2000 mini-index futures. Since early June, longs are essentially unchanged at 54k contracts, versus 57k, even as shorts have more than doubled their positions, to 205k from 90k. Technicals favor this bearish bias. After the ETF, and of course the euro, broke down in July falling out of a July 2012 trend channel, shorts have added 90k more futures contracts; on a monthly chart, both July and August show solid red candles. If technicals prevail, there is more to go on the downside long-term. Needless to say, on a short- to mid-term basis, indicators are way oversold. Nevertheless, things need to stabilize first short-term before bulls can muster strength. They had an opportunity three weeks ago, and that was laid to waste. The catalyst came from ECB President Mario Draghi. At the Jackson Hole meeting, he continued his dovish posture by dangling the carrot of potential asset purchases.

The expected decline in the euro never came. Back on August 11, it looked like the currency was ready for a bounce. Just a bounce, as long-term technicals were only midway through unwinding overbought conditions hence did not call for a sustained rally. Bears simply looked too smug for their own good. Fast forward a couple of weeks, and they have once again been proven right. The FXE fell nearly two percent in August. Bears’ conviction is reflected in Russell 2000 mini-index futures. Since early June, longs are essentially unchanged at 54k contracts, versus 57k, even as shorts have more than doubled their positions, to 205k from 90k. Technicals favor this bearish bias. After the ETF, and of course the euro, broke down in July falling out of a July 2012 trend channel, shorts have added 90k more futures contracts; on a monthly chart, both July and August show solid red candles. If technicals prevail, there is more to go on the downside long-term. Needless to say, on a short- to mid-term basis, indicators are way oversold. Nevertheless, things need to stabilize first short-term before bulls can muster strength. They had an opportunity three weeks ago, and that was laid to waste. The catalyst came from ECB President Mario Draghi. At the Jackson Hole meeting, he continued his dovish posture by dangling the carrot of potential asset purchases.

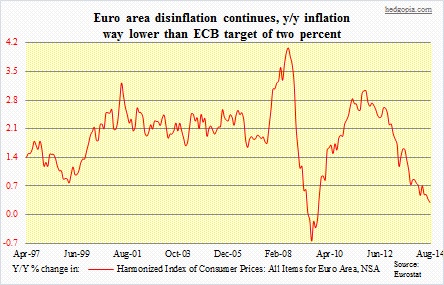

If the Governing Council indeed acts this week, then that could give the bears something more to latch on to. In this scenario, the overbought technical conditions long-term will probably continue to unwind. Rather ominously, on a monthly chart the MACD line is on the verge of flashing a sell signal. If bearish trends continue, the ETF (129.54) has support at 126. The market clearly expects more stimulus – through either even lower ECB interest rates or the start of asset purchases. The Effective Overnight Index Average – Eonia – fell below zero percent for the first time last week. But would the ECB oblige? Indeed, the euro area is experiencing disinflation. Inflation only rose 0.3 percent in August, down from 0.4 percent in July; at least for now, suppressed energy prices are probably the main reason for the low inflation reading. Yields on European bonds are so low markets have preempted the ECB. Besides, consider this quote: “Monetary policy has come to the end of its instruments. I don’t think ECB monetary policy has the instruments to fight deflation.” Guess who said this last week? None other than Wolfgang Schaeuble, German finance minister. Does it sound like a person who will be open to opening up another round of monetary spigot? Last but not the least, the ECB will start offering targeted longer-term refinancing operations next month, and in all probability would want to wait and see how it goes. If Draghi does not deliver this week, then? His decision is due Thursday. Traders can always react to news. But they do/can anticipate one as well. In this respect, non-commercial future traders have done a very good job of riding the euro downtrend since mid-March. We will get clues this Friday as to what they were anticipating this Thursday might bring and how they were positioning themselves. That is when the CFTC reports futures positions as of today.

If the Governing Council indeed acts this week, then that could give the bears something more to latch on to. In this scenario, the overbought technical conditions long-term will probably continue to unwind. Rather ominously, on a monthly chart the MACD line is on the verge of flashing a sell signal. If bearish trends continue, the ETF (129.54) has support at 126. The market clearly expects more stimulus – through either even lower ECB interest rates or the start of asset purchases. The Effective Overnight Index Average – Eonia – fell below zero percent for the first time last week. But would the ECB oblige? Indeed, the euro area is experiencing disinflation. Inflation only rose 0.3 percent in August, down from 0.4 percent in July; at least for now, suppressed energy prices are probably the main reason for the low inflation reading. Yields on European bonds are so low markets have preempted the ECB. Besides, consider this quote: “Monetary policy has come to the end of its instruments. I don’t think ECB monetary policy has the instruments to fight deflation.” Guess who said this last week? None other than Wolfgang Schaeuble, German finance minister. Does it sound like a person who will be open to opening up another round of monetary spigot? Last but not the least, the ECB will start offering targeted longer-term refinancing operations next month, and in all probability would want to wait and see how it goes. If Draghi does not deliver this week, then? His decision is due Thursday. Traders can always react to news. But they do/can anticipate one as well. In this respect, non-commercial future traders have done a very good job of riding the euro downtrend since mid-March. We will get clues this Friday as to what they were anticipating this Thursday might bring and how they were positioning themselves. That is when the CFTC reports futures positions as of today.