- So far this week, both bulls and bears can claim victory

- Watch out when VIX breaks out of downward sloping Oct 14 trendline

- Bulls have ball and could prove costly if they fumble; SPX at crucial technical level

Bulls = 1, Bears =1.

Thus reads the scorecard so far this week.

One week ago yesterday, the S&P 500 large cap index (2123.48) scored an intra-day all-time high of 2134.72. The index had just broken out of a nearly-three-month range. Things could not be looking any better. Bulls sat on the driver’s seat. One week has passed, and we probably cannot make that same assertion with the same level of conviction.

Tuesday gave a big jolt to what otherwise has been a pleasant ride. Bears took over that day, and were able to inflict some damage. Not only was the index pushed down below the breakout point but it also lost the October 2014 trendline. This is not the first time in the last seven months the index has lost that trendline. It happened on May 6 (blue arrow in Chart 1), but it was fleeting; two days later the index was back above it.

With the strong action yesterday, the S&P 500 is essentially sitting on the confluence of that dual resistance. One more nice push, and it will be back above it. The breakdown will have been negated. While this remains a possibility, between then and now, some notable differences have occurred elsewhere.

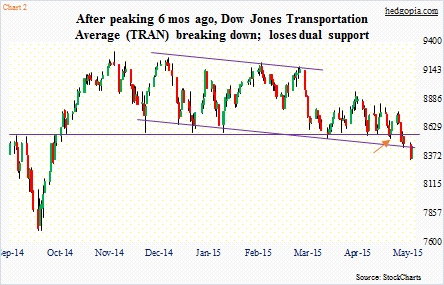

On May 6, the Dow Jones Transportation Average (TRAN) was still above its nine-month horizontal support (orange arrow in Chart 2). Now, it has lost that. As well, it has broken below the channel it has been in from the start of 2015. Once again, with the one-plus-percent move yesterday the Average now finds itself right underneath the lower end of that channel.

The next few sessions are crucial.

This also applies to VIX, the volatility index. In the middle of last October, the S&P 500 came very close to losing 10 percent before reversing. The so-called fear index peaked at an intra-day high of 31.06 then. The S&P 500 has gone on to make one after another new high, even as the VIX has consistently made lower highs (Chart 3). On Tuesday, it rallied 20-plus percent intra-day but was stopped right at that downward sloping trendline. The range is getting narrower. A decision time is approaching.

As things stand now, there is enough divergence in data for both bulls and bears to cherry pick to support their own bias – probably what happens when not everything is moving in sync. Bears, for instance, can point to the lagging transports. Bulls can point to the recent breakout by regional banks, and semis yesterday.

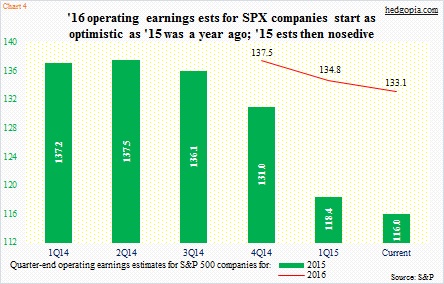

It is natural for bears to point out how 2015 operating earnings estimates for S&P 500 companies have nosedived. The path of downward revision has been ugly. By 2Q14, estimates for this year stood at $137. It is $116 now (Chart 4). Earnings were $113 last year. On 2015 estimates, the S&P 500 trades at north of 18x. Not cheap. Bulls are no longer focused on 2015, rather 2016. Over the last two quarters, 2016 estimates have come down as well, but nothing comparable to what 2015 has been through. By the way, as early as 4Q14, 2015 estimates stood at where 2016 estimates are currently. Makes you wonder what kind of faith one should put in these estimates.

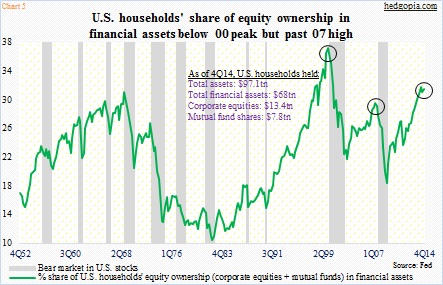

Or take Chart 5, for that matter. It shows U.S. households’ exposure to equities. As a percent of financial assets, it stood at 31.1 percent in 4Q14 (1Q15 numbers are not out yet). This is higher than the 29.1 percent in 2Q07, shortly before things began to come apart, but not as high as the all-time high of 36.8 in 1Q00. So for bears, the green line is already flashing yellow/red. For bulls, there is room for it move higher still. In other words, no blow-off top just yet.

This pretty much describes the past couple of days – the duel between bears looking for pullback/correction and bulls looking to push the S&P 500 past 2138 and toward 2200. Bulls have the ball right now, and they better not fumble. This is too important a spot for bears to intercept.

Thanks for reading!