- Ahead of ECB meeting, euro misery continues

- Draghi under pressure to deliver news of more stimulus

- Large speculators look tentative and sitting on massive net shorts

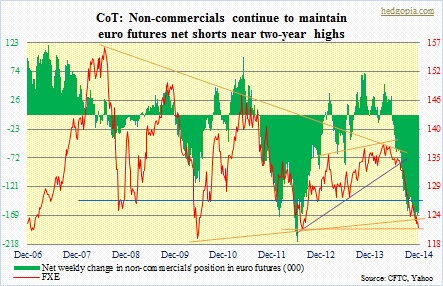

When early October, FXE, the euro ETF, was unable to hold on to 126-127, we suspected that it “could very well be headed toward 118-120 if technicals rule”. The ETF closed yesterday at 121.27 (traded as low as 121.14), in the process breaking another minor support at just under 122. Such has been the story of the euro. Since it peaked at just under 138 this March, for the umpteenth time it looked like it was getting ready to stabilize, only to head lower still. The latest bout of weakness came as (1) toward the end of October the ETF failed at the previously broken support (blue line in the bottom chart), and (2) Mario Draghi, ECB president, began dropping hints that more stimulus was on the way.

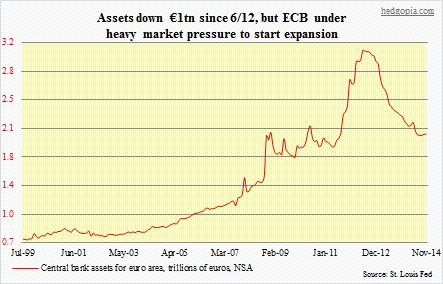

Weak euro action yesterday ahead of the rate meeting this AM, was suggesting as much – that markets want something from Draghi. Odds are extremely low that he would oblige right away. (Unless he wants to pull a Haruhiko Kuroda. The latter, BoJ governor, surprised markets on October 31st by announcing plans to massively expand what was already a bloated balance sheet.) But currency markets are betting that more stimulus is on the way in the eurozone come early next year. UBS now expects the ECB to announce a plan in March next year to purchase €1tn of sovereign bonds over two years. Draghi is under pressure to deliver.

From the currency’s perspective, the what (price action) is more important than the why (news). (1) It is a head-scratcher really. If the ECB does indeed start buying sovereign bonds, how much lower would rates go? Rates not low enough to spur loan demand? Yes, eurozone banks are probably front-running the central bank, but 10-year yields are already shockingly low – 0.74 percent in Germany, one percent in France, 1.98 percent in Italy, 1.83 percent in Spain, just to pick a few. Hence it is equally possible Draghi may just continue his verbal intervention. If it isn’t broke, don’t fix it. (2) Let us say Draghi delivers. But could it be priced in already? There is no way to know that now. But we saw a similar phenomenon in gold on Monday; the initial weakness was quickly bought. (3) This is where hedge funds come in. At the time FXE fell out of a two-year-old wedge pattern in July this year (indigo line in the chart above), large speculators were net short 63k contracts. Once that breakdown occurred, they gradually added to their net short positions. Then mid-September another support was taken out – (blue line). They added even more – net shorts peaked early November at 179k. The past three weeks, they are essentially unchanged at 160k-plus. So if and when markets decide that (1) Draghi is bluffing, or (2) potential ECB action is already priced in, these net shorts can be a tremendous source of squeeze.

Wait-and-watch for now.