On a day when we are enjoying the blockbuster 3Q GDP numbers comes another data point that points to continued sluggishness in U.S. housing.

Yesterday, existing home sales disappointed. Sales were lowest since May this year. I even heard one guy on Bloomberg Ratio saying not to pay attention to November; rather March, April are the months that matter. This is true in some sense, as these are spring months. But this is a widely known factor, hence has got to be built into analysts’ expectations. And that is the point. Sales (4.93mn, SAAR) were weaker than expected.

Here we go again. Earlier today, new home sales were reported. Nothing much to write home about. Sales (438k) were below expectations, and lowest since September’s (455k). The inability of housing to get traction given where mortgage rates are and the improvement in the jobs market this year is perplexing.

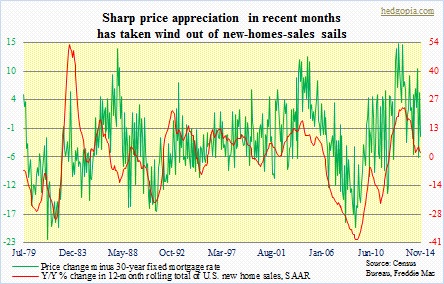

One of the things that has been a thorn in the side of sales has got to be the price. At $291.7k in August, the median price of a new home stood at an all-time high (November was $280.9k). Back in 2007, it peaked at $262.6k in March. Yep, the median price of a new home is higher than during the epic bubble. The price of an existing home peaked at $222k in June this year (November was $205.3k). The only solace: unlike new homes, the price of an existing home is still below the high of $230.4k reached in July 2006.

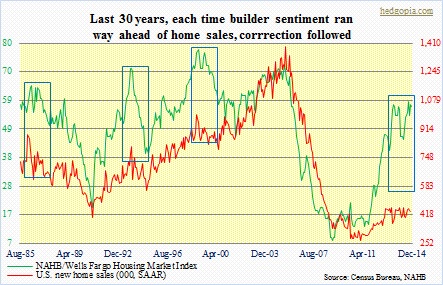

In the midst of all this, builder sentiment continues to stay elevated. If past is any indication, it is only a matter of time before the law of gravity exerts its force. Their sentiment, by the way, tends to correlate with housing stocks.