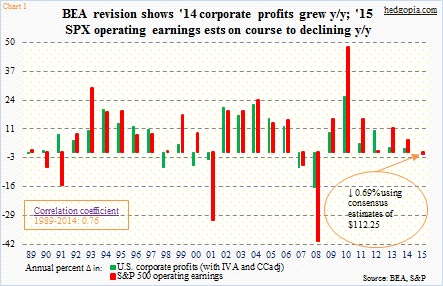

A July 2nd post discussed the possibility that operating earnings for S&P 500 companies might decline this year over 2014. The assessment was based on the relationship between SPX earnings and the BEA’s measure of corporate profits (adjusted for inventory valuation and capital consumption).

From that post:

“Going back to 1989, there have been three years in which the BEA’s measure of corporate profits fell but not operating earnings of S&P 500 companies – 1989, 1998 and 2000 (violet circles in Chart 3). In two of the three, operating earnings of S&P 500 companies fell the following year – 1990 and 2001 (arrows). In 2014, the government’s measure of corporate profits fell 0.8 percent, even as operating earnings of S&P 500 companies rose 5.3 percent. So the question is, what will 2015 bring?” (old post/chart here)

Corporate profits in 2012 through 2014 were originally reported as $2.02 trillion, $2.11 trillion and $2.09 trillion, respectively. They have all been revised lower – to $2 trillion, $2.04 trillion, and $2.07 trillion, in that order. This now means that profits did not peak in 2013, and that 2014 was not a down year (Chart 1). So the signal mentioned in that post is no longer at work. With that said, on a quarterly basis, corporate profits did peak at 3Q14 at a seasonally adjusted annual rate of $2.16 trillion, with 4Q14 at $2.14 trillion and 1Q15 at $2.01 trillion. So this may just be a matter of semantics, come to think of it.

Why?

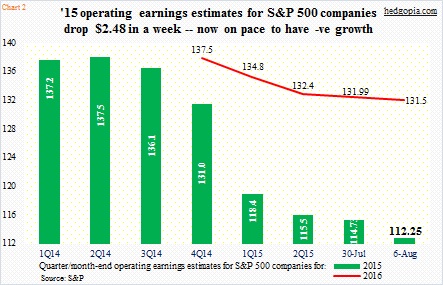

Because 2015 operating earnings estimates last week were revised down big time. Up until July 30th, consensus estimates were $114.73. A week later, this nosedived to $112.25 (Chart 2). With nearly 90 percent of the companies reporting, much of the downward revision was due to 2Q, which went from $28.46 to $26.45; 3Q was revised lower from $29.29 to $29.02 and 4Q from $31.18 to $30.97.

If 2015 estimates come in as expected, this would be the first year since 2008 that operating earnings for S&P 500 companies would have contracted. In 2014, earnings were $113.02.

Rather worryingly, momentum is on the downside.

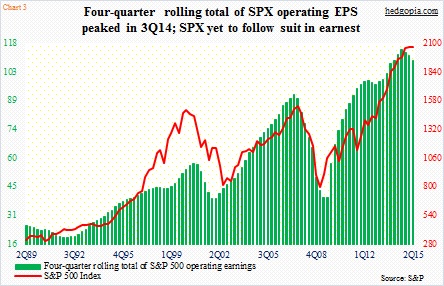

Using a four-quarter rolling total, operating earnings peaked in 3Q14, the same quarter the BEA’s measure of U.S. corporate profits peaked. Since that peak ($114.51), operating earnings (four-quarter rolling total) have dropped by nearly $6.

Here is the rub. If the earnings deceleration as shown in Chart 3 sustains, odds are high that the S&P 500 Index will sooner or later catch up to it. At least that is how things have evolved in the past. This probably becomes a moot issue if 2H15 and 2016 estimates are met – the latter in particular. But is it likely?

Estimates for 2015 were as high as $137.50 as of 2Q14 (Chart 2). Now they are $112.25. Oddly enough, 2016 estimates were $137.50 as of 4Q14, and have only been cut to $131.50. If estimates for both 2015 and 2016 are met, earnings would have grown north of 17 percent next year! This at a time when GDP growth continues to be tentative – with each quarter having grown at a seasonally adjusted annual rate of 2.2 percent since Great Recession ended.

Put it all together and it is not hard to conclude 2016 estimates might be a little too rosy. As they get revised downward, the four-week rolling total in Chart 3 will continue to come under pressure, raising the risk that the red line in the same chart catches up to the green bars.

Thanks for reading!