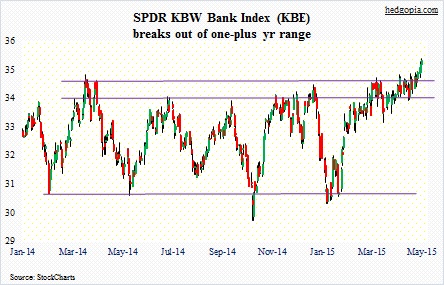

A month ago, KBE, the SPDR S&P Bank ETF, looked on the verge of a breakout (more here). Here we are, one month later, the ETF has indeed broken out.

It has the potential to be a major breakout, as the ETF ($34.83) has pushed through a range that was in place for over a year. A technician will come up with a measured-move target of $38.

In many respects, it is a head-scratcher. But it is what it is. Right here and now, price action is good, and should be respected.

It is possible the sharp rally in U.S. interest rates of late played a role in this, but this cannot be the only reason why the ETF is acting the way it is.

Why then is the breakout a head-scratcher?

First of all, XLF, the other ETF for financials, is still below its late-December high. Not by a whole lot, nonetheless no breakout yet. But there probably is good explanation for this.

XLF is dominated by large-caps. The ETF holds 89 stocks, with five companies making up more than a third of the allocation – BRK.B (8.7 percent), WFC (8.6 percent), JPM (eight percent), BAC (5.7 percent), and C (5.4 percent).

KBE is different. The number of holdings stands at 65, with regional banks making up 78 percent. The Big Four together make up less than seven percent – JPM, 1.66 percent; BAC, 1.58 percent; and C and WFC, 1.55 percent each.

Of these four, only JPM is at a new high. This explains XLF’s underperformance versus KBE. But why is the latter outperforming? The answer probably lies in its large exposure to regional banks. As a matter of fact, KBE’s chart can be mistaken for KRE’s, the SPDR Regional Bank ETF. They move together.

Regional banks need the domestic economy to do well. Quite a few of them have decent exposure to housing, where momentum has decelerated. The economy barely grew in the first quarter (0.2 percent).

We can ignore 1Q weakness as a rearview mirror look, but the second quarter has not gotten off to a great start either. Retail sales were sluggish in April. As of May 13, the Atlanta Fed’s GDPNow model is forecasting 0.7 percent in real GDP growth in the second quarter – much lower than the consensus. The model was spot on in the first quarter.

The only conclusion we can draw from this is either the regional banks are pricing in a sharp rebound in economic activity in the second half – no guarantees – or the breakout is a head fake.

Ideally, a breakout will go through a retest. If it is genuine, there will be willing buyers near $34. Daily conditions are grossly overbought. In all probability, a retest is around the corner, which will decide if it is a breakout or a fake out.

Thanks for reading!