Here is a brief review of period-over-period change in short interest in the January 1-13 period in the Nasdaq and NYSE Group as well as nine S&P 500 sectors.

Nasdaq – short interest ↓ 0.4% p/p; Nasdaq composite ↑ 3.5%

Toward the end of 2016, it looked like the composite was on the verge of a bearish cross-under between 10- and 20-day moving averages. That did not come to pass, as 2017 started out strong, with the January 1-13 period ending with both averages pointing up, and the index scoring a new all-time high of 5584.26 on January 13 (surpassed by record high 5658.59 this Wednesday).

The 3.5-percent rally in the composite was not due much to short squeeze. Shorts essentially stayed put p/p. Conviction all right, but misplaced? Time will tell.

NYSE Group – short interest ↓ 0.1% p/p; NYSE composite ↑ 1.5%

During the January 1-13 period, a potentially bearish 10/20 daily cross-under came close to completing but was denied in the nick of time.

The composite did rise to a new all-time high of 11264.17 on January 5, although resistance at 11250 continued to hold sway. Bulls have been hammering at that since April 2015 (taken out this Wednesday – fresh intra-day high of 11343.78).

…

Of the nine S&P 500 sectors below, short interest fell p/p in six (XLB, XLF, XLP, XLU, XLV, XLY) and rose in three (XLE, XLI, XLK). During the period, all nine sectors were above their 50-day moving average.

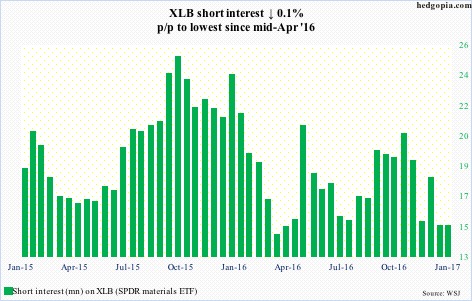

XLB (SPDR materials ETF) – short interest ↓ 0.1% p/p, ETF ↑ 2.4%

XLB found support on the daily lower Bollinger band on the last trading session of 2016 as well as the first session of 2017. Soon, it found support on 10- and 20-day averages, followed by a bullish crossover. Support at $50 was tested and held.

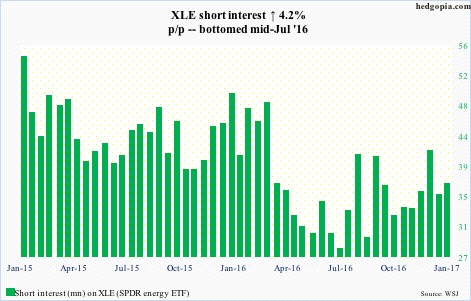

XLE (SPDR energy ETF) – short interest ↑ 4.2% p/p, ETF ↓ 1.2%

XLE peaked on December 12 at $78.04, and has been under pressure since, trading within a declining channel.

The weekly chart is on the verge of a bearish MACD cross-under. Shorts added some.

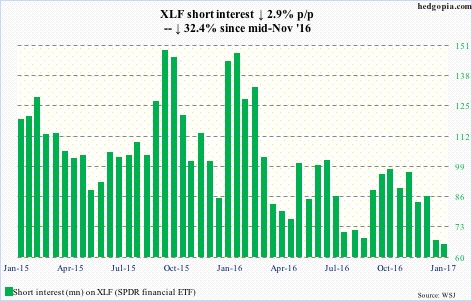

XLF (SPDR financial ETF) – short interest ↓ 2.9% p/p, ETF ↑ 1.1%

Beginning early December, XLF began to trade within a range – $23.75 on the up and $23.20 on the down. The range-bound action continued during the reporting period, with daily Bollinger bands tightening. Shorts, who have been cutting back, likely anticipate a breakout.

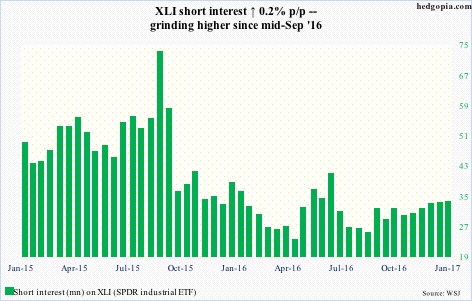

XLI (SPDR industrial ETF) – short interest ↑ 0.2% p/p, ETF ↑ 1.6%

In July last year, XLI broke out of a months-long $46-$55.50 range, giving technicians a target of $65. The ETF early last month rose to $63.68 before going sideways. The measured-move target still has some room to run (this Wednesday, it rose to $64.47).

Shorts have been gradually adding, though not aggressively.

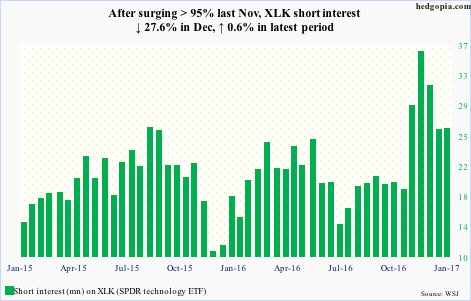

XLK (SPDR technology ETF) – short interest ↑ 0.6% p/p, ETF ↑ 2.7%

A laggard post-election, XLK did a 360 as soon as 2017 began. It keeps churning out new highs. Shorter-term moving averages, now pointing up, are helping. Short interest, which had surged 95 percent last November, got unwound some, otherwise shorts are staying put.

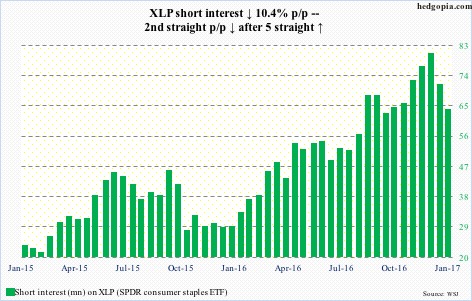

XLP (SPDR consumer stables ETF) – short interest ↓ 10.4% p/p, ETF ↓ 0.4%

For the most part, defensives were shunned during the January 1-13 period. Bulls nonetheless continued to defend XLP’s 50-day moving average, but also struggled to take out resistance at $52-plus.

Despite the 10.4-percent drop during the period, short interest remains elevated.

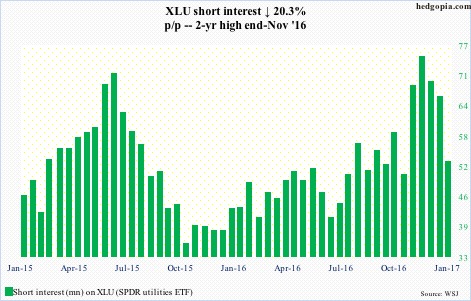

XLU (SPDR utilities ETF) – short interest ↓ 20.3% p/p, ETF ↓ 0.1%

XLU pretty much spent the entire reporting period around its 200-day moving average. Has been sideways since mid-December last year. The 50-day is gradually nudging higher.

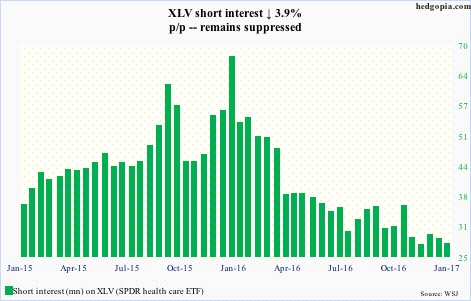

XLV (SPDR healthcare ETF) – short interest ↓ 3.9% p/p, ETF ↑ 2.9%

XLV rallied in the first six sessions of 2017 – past its 200-day moving average – then peaking at $71.91 in a long-legged doji week.

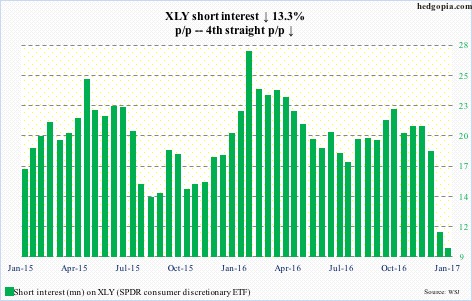

XLY (SPDR consumer discretionary ETF) – short interest ↓ 13.3% p/p, ETF ↑ 3.1%

XLY finds support on the lower Bollinger band in the very first session of the year. This also approximated four-and-a-half-month support at $81-plus. Bulls are also defending shorter-term moving averages.

Shorts likely anticipated this. Short interest went down 48 percent in the past month.

Thanks for reading!