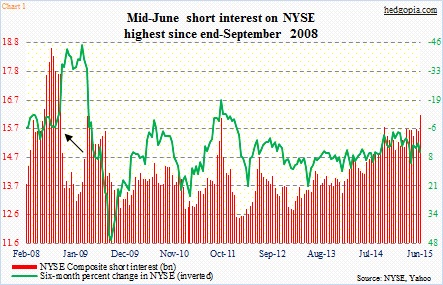

The latest (mid-June) short-interest reports are intriguing in some respects.

On both the NYSE Composite and Nasdaq Composite, short interest jumped period-over-period, to 16.2 billion and 8.9 billion respectively – up 3.6 percent and 3.4 percent, in that order. (Check out this tweet for short interest on SPY, the SPDR S&P 500 ETF.)

On the NYSE in particular, there has been a noticeable increase in activity.

The last time NYSE short interest rose to 16-billion-plus was at the end of September 2011 (16.1 billion). The index bottomed soon after – early October – squeezing the shorts; by the end of January 2012, short interest had declined to 12.5 billion.

The current level of NYSE short interest is also higher than when stocks bottomed in the middle of October last year. Back then, it stood at 15.8 billion. Since then, from low to high, the index went on to rally nearly 14 percent. Rather noticeably, short interest only declined five-percent-plus to 14.9 billion by end-December before rising. This time around, shorts are hanging in there, even though they are only hitting singles and doubles – no home run just yet.

This can be an opportunity for the bulls. Let us see if they can deliver – by squeezing the shorts, that is.

With that said, it is worth pointing out what took place in 2008. On the NYSE, the current count is the highest since 17.7 billion at the end of September 2008 (arrow in Chart 1). At the end of October 2007, short interest was 11.7 billion and then rose all the way to 18.6 billion by the end of July 2008, before dropping. With the benefit of hindsight, every time short interest rose back then – from 12 billion to 14 billion to 16 billion – it must have felt like shorts were setting themselves up for a squeeze. Instead, they ended up having the last laugh.

So in the right circumstances, short interest can always move higher from the current levels. The bears will need a catalyst.

If things do not get resolved in Greece soon, could that snowball into something more sinister? Stocks are not prepared for this scenario. Would the Fed really end up raising rates later this year, and if so can the U.S. economy handle it? Or, for that matter, how about emerging economies? Are they ready for a U.S. tightening cycle to begin? There are $9 trillion owed by borrowers outside the U.S. Or how about some unforeseen accident somewhere? When monetary policy is as easy as has been the last six-plus years, it is probably prudent to expect a curve ball here and there.

Barring that, this is as good an opportunity as any for the bulls to try to use the elevated short interest to their advantage.

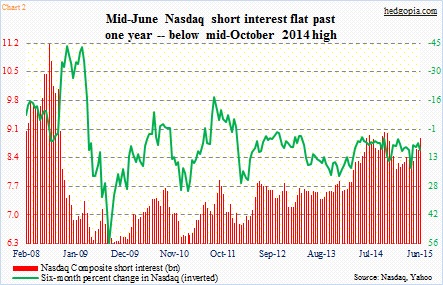

This is particularly so considering that the shorts are not as aggressive with the Nasdaq as they are with the NYSE. In other words, they are not smelling blood everywhere.

On the Nasdaq, the mid-June count is lower than the mid-October level of 9.02 billion (Chart 2), and has pretty much gone sideways for a year now. Back in 2008, it rose as high as 11.2 billion in the middle of July.

One possible reason for this divergence is that the NYSE (11035.73) has been range-bound for a year now. In April and May, the index briefly broke out and stayed above 11000, but has fallen back into the range. The Nasdaq (5112.19), on the other hand, recorded its all-time intra-day high (5164.36) this Wednesday.

A lack of across-the-board conviction on the part of shorts has for a while been a recipe for shallow pullbacks as they rush to cover and lock in profit. Just singles and doubles. Only an unexpected curve ball will ensure them a home run. By nature, unexpected events do not come announced!

Thanks for reading!