The PowerShares QQQ (110.05), the ETF that tracks the Nasdaq 100, seems to want to go lower, at least near-term.

When the Qs broke out of 104-plus in February, it quickly added nearly four percent, rallying seven-plus percent for the month. Then things stalled. For seven weeks beginning March, the ETF went sideways, with 109 proving tough to crack. A break higher out of that price range took place late April, but for just a few days (blue arrow in Chart 1). Mid-May, 109 was conquered again. The ETF currently is above that level. In the process, bulls have expended a lot of energy.

The biggest hurdle QQQ faces at the moment is the underside of the broken October 2014 trendline, which was lost soon after that false breakout late April. Daily momentum indicators are beginning to turn lower, and conditions are overbought on a weekly chart.

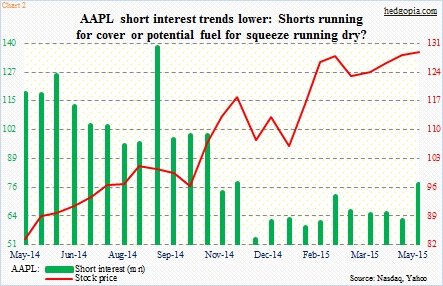

In many respects, as goes AAPL, so goes QQQ. The stock makes up 14.6 percent of the ETF. Its potential short-interest fuel is running dry (Chart 2). Also on QQQ, as of mid-May, short interest stood at 42.6 million, versus 78.7 million at the end of October.

As to momentum – or a lack thereof – in AAPL shares currently, they had a poor reaction to 1Q15 earnings, peaking on April 28th at 133.98 in a session that produced a big bearish engulfing candle. The 133 level is now providing stiff resistance.

Next week, on June 8-12, AAPL will hold its Worldwide Developers Conference. The stock has a history of selling off following the conference. It already rallied in May – just under five percent.

If all this potentially means QQQ comes under pressure near-term, then how to play all this?

If we assume the ETF will remain range-bound between 111 and 109 this week, one way to play this scenario is a weekly June 5th 107.5/108.5/110.5/111.5 iron condor.

In which,

Long 111.5 call for $0.26

Short 110.5 call for $0.67

Short 108.5 put for $0.31

Long 107.5 put for $0.19

It nets a credit of $0.53, with $0.47 at risk. But this is more of a neutral strategy. If the outlook is a little bit more bearish, then this probably does not cut it. In fact, as stated, $0.47 is at risk if the underlying shoots past either 111.5 or 107.5.

Besides, it probably is not a bad idea to be looking to go short QQQ, if the need be. In this scenario, a simple June 5th weekly naked call write will work; 111 calls are selling $0.44. This creates an effective short at 111.44 should the ETF gets bid up. Should it go sideways to down, it remains a trade meant to generate income.

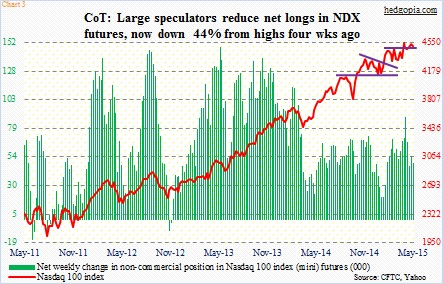

On a related note, large speculators have continued to cut back net longs in Nasdaq 100 index (mini) futures, now down 44 percent from highs just a month ago (Chart 3). They have so far done a good job of riding the uptrend, and are now taking a somewhat of a cautious stance. They are still net long, but with substantially less exposure than they had before.

Thanks for reading!