Financials have been acting better of late. Since November 20 when XLF, the financials ETF, successfully tested its September 19th high, there are bids underneath particularly large-cap financials. The stocks responded very well to the jobs report last Friday. This morning is no exception. Early weakness was bought right out of the gate. The session is still young, so it is too early to say. Nonetheless on a daily chart, the leading ones – GS, C, BAC, JPM, WFC – have all broken out. This is counterintuitive given that the 10-2 spread continues to tighten. And this is their bread and butter, as they lend long and borrow short.

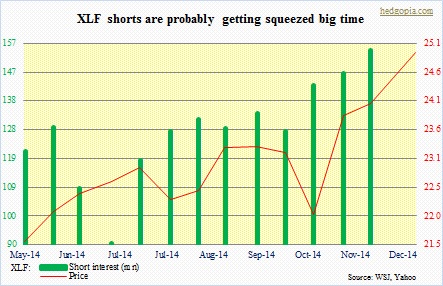

While it is difficult to put two and two together, there is probably something else going on. Short interest on the ETF has persistently increased since end-June – up north of 70 percent (as of mid-November). Shorts continued to add even as stocks bottomed mid-October. And this may very well be acting as a tailwind behind these stocks. Shorts are getting squeezed.