Gold is anything but golden these days. It has lost its luster. Not the metal, of course; it still glitters. As an asset, however, it is down in the dumps.

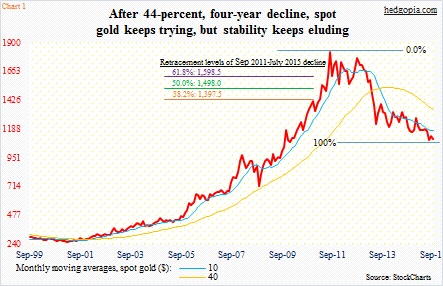

Since its peak in September 2011 through the low this past July, spot gold lost 44 percent. In a larger scheme of things, this decline should be viewed as normal, in that the metal rallied north of 650 percent between the April 2001 low of $255.80/ounce and the September 2011 peak of $1,923.70. But the ones who went long during the past five years and sat on it are sitting with bruises.

If there is any consolation for gold bugs, it is that the July low of $1,072.30 has the potential to be important technically, as it approximates 50-percent retracement of the April 2001-September 2011 rally ($1,090, to be exact).

Should that low hold, and the metal gradually begins to retrace the September 2011-July 2015 decline, there is a lot of unwinding left to be done. Just retracing 38.2 percent gets the metal to just under $1,400 (Chart 1).

But before that happens, gold needs to stabilize, and this is where it continues to struggle.

It has not been able to rally on what in normal circumstances should be gold-friendly news.

On September 3, Mario Draghi, ECB president, signaled that the ECB may have to step up its quantitative easing (QE) program; since March, the bank has been purchasing €60 billion a month in mainly public assets. In other words, more money gets printed and is pushed into the system. The metal acted totally indifferent to the news. Also, when it peaked four years ago, U.S. QE2 had just ended, which was fine, but it continued lower even after QE3 got underway.

This has to be disheartening for gold bugs. And the picture has not changed.

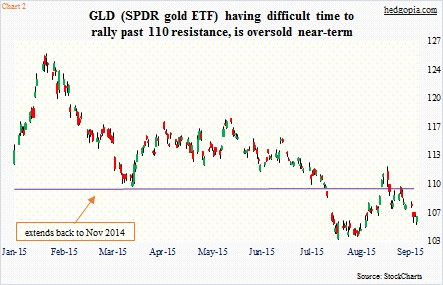

GLD, the SPDR Gold ETF, lost support at $114.50 six months ago, then proceeding to lose another support at $110 (Chart 2). The latter resistance already rejected a rally attempt on September 1. To boot, the 50-day moving average is pointing lower. Last week, the US dollar index dropped 1.1 percent, and gold moved in tandem, dropping 1.3 percent!

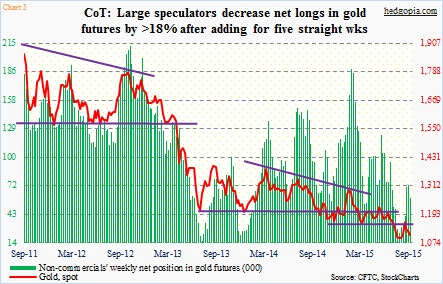

The frustration is beginning to get reflected on non-commercials’ holdings in gold futures. After adding to net longs for five straight weeks, they reduced net longs by 18 percent last week (Chart 3) – probably a reason why the metal fell last week. Short interest on GLD has gone up from 9.4 million to 13.6 million the past couple of months (latest count is as of August-end).

In the near-term it is possible all this is creating an opportunity.

In two out of the last three sessions, GLD ($106.16) has bounced off of its lower Bollinger band, and is now oversold on a daily chart. With that said, in the medium-term, there is room for it to head lower still. This probably opens the door for weekly options. Once again, a cash-secured put comes to mind. Hypothetically, September (expires on the 18th) 105.50 puts bring $0.76. If put, it is an effective long at $104.74 – not too far away from the July 24th low of $103.43. But the idea is not to go long, rather just generate income. The previous GLD option trade, which originally did not go as expected, was finally gotten rid of for a profit of $0.63.

Thanks for reading!